-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

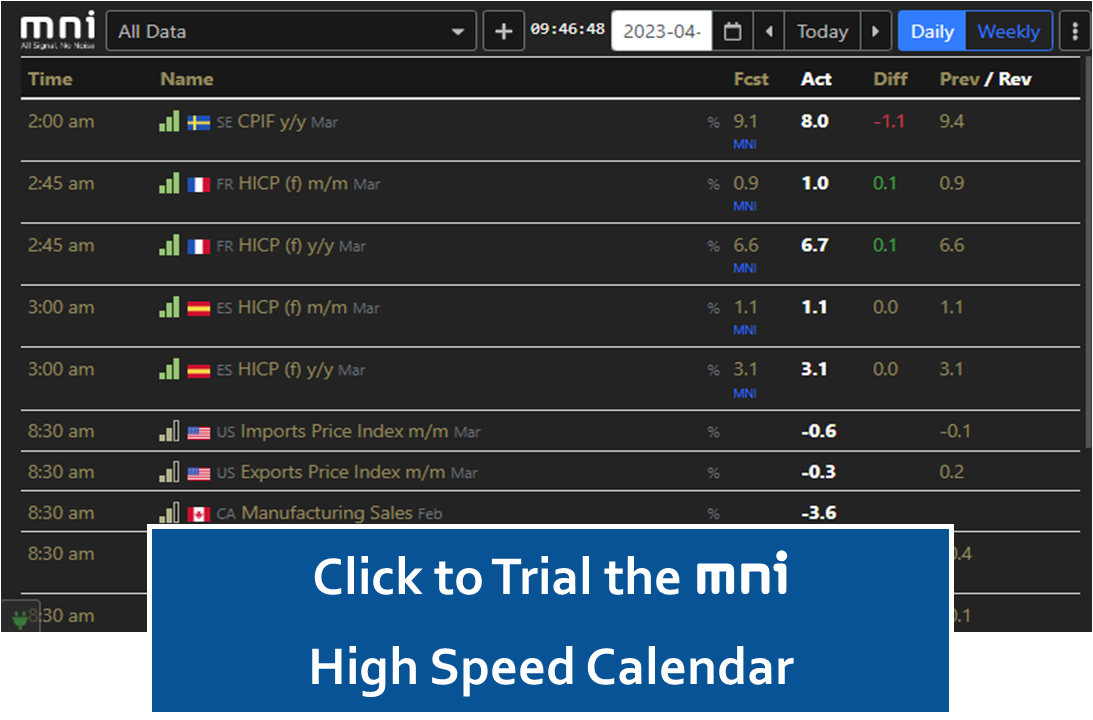

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

MNI BOK WATCH: Board To Hold At 3.5%, Rate Cut Delayed To Q4

Sticky inflation and an uncertain U.S. Federal Reserve will stay the BOK board's hand when it meets Thursday.

MNI Bank Indonesia Preview – May 2024: Stronger IDR, BI On Hold

We do not expect BI to raise rates again at its May 22 meeting but FX stability will remain its focus and the tone of the statement will be in line with this.

MNI POLICY: BOJ Board Weighs Pace, Scale Of JGB Reductions

BOJ board members are watching decreased JGB buying operations to determine the feasibility of a wider reduction.

MNI BRIEF: China Manufacturing Shows Positive Trend - NDRC

Beijing is counting on improved manufacturing.

MNI China Press Digest May 21: Bonds, Trade, LPR

MNI picks keys stories from today's China press

BOJ Board Weighs Pace, Scale Of JGB Reductions

BOJ board members are watching the market to determine how much the Bank can shrink its JGB buying operations -- on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

Consumer Sentiment Sours In May, Warning Sign For Biden

The University of Michigan index of consumer sentiment saw its biggest drop since 2021 in May - dropping to a six-month low - reflecting consumer concerns over inflation and rising prices.

- The Washington Post notes: "The economy, while still remarkably strong, has slowed in recent months as the Federal Reserve tries to get inflation under control. Employers are adding fewer jobs, wage growth has decelerated, and Americans are holding off on big purchases like homes, cars and washing machines."

- Jeffrey Roach, chief economist for LPL Financial said: “For the last couple of years, the economy has been driven by household spending and now people are starting to say, ‘Let’s retrench here. The pressure from inflation has finally started to hit even upper-income households.”

- The shifting sentiment is a warning sign for President Biden as the White House economic message - largely driving by positive data - has failed to resonate with voters facing persistently high prices.

- Celinda Lake, a Democratic pollster, noted the particualr concern of gas prices which have risen by roughly 50 cents per gallon since the start of the year on average: “People tend to know the cost of gas, block by block, and they deeply resent it when gas prices go up right before summer vacation.”

Figure 1: Index of Consumer Sentiment

Source: Washington Post/ University of Michigan

Biden Weakness In Sun Belt Tips Presidential Race Towards Trump

Split Ticket has published a useful analysisof the current state of the presidential race with rating changes reflecting polling giving former president Donald Trump a slight advantage over President Biden.

- Split Ticket: “Polls are now more relevant, given increasing proximity to the election. While the fundamentals of the race, which include the issue landscape, campaign cash levels, and candidate vulnerabilities, continue to favor Joe Biden, polling now gives Donald Trump a slight edge.”

- Split Ticket notes: “…our new ratings reflect current data, which points to a more Republican environment than the one we got in 2020.”

- The analysis identifies several dynamics contributing to the shift towards Trump including a fraying progressive coalition in Sun Belt states – in particular a weakness for Biden amongst Black voters in Georgia and Hispanic voters in Nevada and Arizona.

- Axios notes that top Democrats, including President Biden, are sceptical of the polling shift – adding that, “After Trump's 2016 expectation-defying win, pollsters and strategists made adjustments aimed at better capturing Trump supporters,” an adjustment which some Democrats believe may have led to a bias on the other side of the ledger.

- Senator Raphael Warnock (D-GA) said: "The polls showed that I was down when I entered my race. And polls didn't look that great for Angela Alsobrooks [in the Maryland Democratic Primary] a couple weeks ago."

Figure 1: Presidential Rating Changes, May 2024

Source: Split Ticket

Actions Of UCG Will Deter Other "Would-Be Aggressors"

- Brown says: "Our support for Ukraine is not merely an act of solidarity. It is a strategic necessity that reinforces broader international security. If unchecked, Russian aggression could embolden other authoritarian regimes to challenge international norms and violate the sovereignty of their neighbours."

- Austin said the UCG heard directly from Ukraine’s defence leaders on the new Russian offensive around Kharkiv. Austin says: "Ukraine’s defenders are in a hard fight… Putin is betting that eventually Ukraine will fold… but he is wrong. We spent a lot of time on air defence systems… and will continue to push that Ukraine can own its skies.”

- Austin sidesteps a question on whether the US should approve Ukrainian strikes within Russia: "Their focus should be on the close fight and servicing those targets that will enable success in the close fight." Brown says he is "confident" that Ukraine has not used long-range US weapons within Russia.

- Separately, Austin says the death of Iranian President Ibrahim Raisi in an air accident yesterday hasn't provoked any change in US force posture and he "doesn't see any broader regional security impacts at this point in time." He later stresses that the US played "no part" in the helicopter crash.

MNI REAL-TIME COVERAGE

Tomas Holub Says It's Too Early To Say If CNB Will Slow Pace Of Cuts In June

Timely & Actionable Insight on Central Bank Policy

Timely & Actionable Insight on FX & FI Markets

Timely & Actionable Insight on Emerging Markets

Sample MNI

MNI NEWSLETTERS

MNI EUROPEAN MARKETS ANALYSIS: RBNZ Seen On Hold Tomorrow, Tone Likely Unchanged

MNI EUROPEAN OPEN: Hong Kong/China Equity Rebound Loses Some Momentum

MNI ASIA OPEN: Tsys Inch Lower Ahead May 1 FOMC Minutes

MNI ASIA MARKETS ANALYSIS: US$ Gain, Corporate Supply Weighed

MNI US MARKETS ANALYSIS: New All-Time Highs For Gold

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.